Product strategy question: Entering new market strategy

Which market Waymo should target to expand internationally?

Product strategy questions are commonly asked in most PM interviews and are even more frequent when interviewing for senior-level roles.

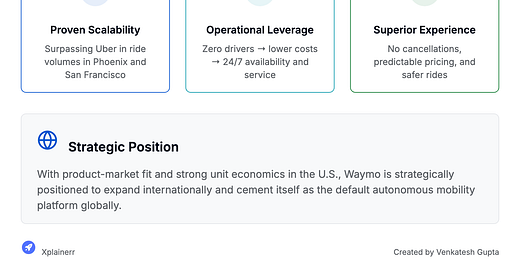

Waymo, a pioneer in autonomous vehicles (AV), has recently surpassed Uber in ride volumes in cities like Phoenix and San Francisco — signaling:

✅ Scalability of its AV platform

💸 Operational leverage: 0 drivers → lower costs → 24/7 availability

🌟 Superior customer experience: No cancellations, predictable pricing, safer rides, enhanced privacy

With PMF and strong unit economics in the U.S., Waymo is now strategically positioned to expand internationally and cement itself as the default autonomous mobility platform globally.

2. Market selection framework

To select the ideal international market, I will use this framework:

🌍 Market Size: Proxy → Uber’s 2024 regional revenue (mobility TAM indicator)

👥 User Readiness: Tech-savviness, smartphone penetration, openness to innovation

🏛️ Regulatory Alignment: AV-friendly policies, centralized governance, testing permit ease

2.1 Uber 2024 Revenue – Regional breakdown

Uber’s 2024 (est.) revenue by region — used as a proxy for mobility TAM:

Notable markets with major revenue contributors

US & Canada $27.4B | San Francisco, NYCE

MENA $10.1B | 🇫🇷 France, 🇩🇪 Germany, 🇦🇪 UAE

APAC $4.3B | 🇮🇳 India, 🇦🇺 Australia

LATAM $2.1B | 🇧🇷 Brazil, 🇲🇽 Mexico

While Uber doesn’t disclose city-level revenue, MENA represents the second major region for Uber revenue.

2.2 User readiness – Comparative snapshot

🇦🇪 Dubai

🚀 Extremely high tech adoption

📱 Smartphone penetration >98%

🧠 Public highly open to innovation and futuristic services

🇫🇷 Paris

🚀 Strong but traditional tech usage

📱 Smartphone penetration around 85%

🧠 Moderate openness; some resistance to disruptive mobility

🇩🇪 Berlin

🚀 Solid tech infrastructure

📱 Smartphone usage ~82%

🧠 Moderate innovation receptiveness, more focused on local players

✅ Dubai leads with a highly connected, tech-forward population — ideal for early AV adoption.

2.3 Regulatory alignment – city comparison

🇦🇪 Dubai

🏛️ Strong government backing (25% AV target by 2030)

🧪 Fast-track AV testing permits and pilot approvals

🧭 Centralized governance enables rapid policy execution

🇫🇷 Paris

🏛️ Supportive, but bureaucratic and slow-moving

🧪 AV testing requires multi-level approvals

🧭 Decentralized; unions and local governments complicate ops

🇩🇪 Berlin

🏛️ Favorable at federal level, but inconsistent locally

🧪 Testing frameworks exist but slow to scale

🧭 Federated governance = slower market entry

✅ Dubai is clearly the most launch-friendly environment, offering fast execution, strong alignment, and national-level AV ambition.

3. Dubai’s GTM strategy

🎯 Objective

Launch Waymo’s first global ride-hailing service in Dubai to:

Establish international AV brand leadership

Validate tech stack + ops outside the U.S.

Build a scalable GTM playbook for other global cities

🧭 Market positioning

Positioning: Premium, private, always-on smart mobility

Tagline: “Your private driver. With no driver.”

👥 Target segments

👨💼 Urban professionals: Tech-savvy, high-income commuters in Business Bay, Marina

🧳 Tourists: DXB airport transfers, hotel–mall circuits

🏢 Smart enterprise: Office parks, Expo City, RTA, gov-backed deployments

🏛️ Regulatory & policy alignment

Partner with:

RTA (Roads & Transport Authority)

Dubai Future Foundation

Smart Dubai

Align with:

Dubai’s Smart Mobility 2030 Vision

Secure:

AV testing + operating permits

Fleet import policies and insurance frameworks

Local AV liability frameworks

🤝 Local partnerships

📶 Connectivity

Partners: Etisalat, Du

Role: Enable 5G + edge computing for real-time AV decision-making and low-latency operations

🚦 Transport Authorities

Partners: RTA (Roads & Transport Authority), DXB Airport

Role: Define AV routes, pickup/drop zones, and integrate with city mobility plans

🏢 Real Estate & Infrastructure

Partners: Malls, hotel chains, Downtown developers

Role: Offer parking spaces, test environments, and generate B2B ride demand

🗺️ Maps & Localization

Partners: Local GIS & navigation providers

Role: Provide road-level data, decode traffic signage, and localize routing logic

🌐 Product localization

Arabic UI in app and AVs

Payments: Apple Pay, Samsung Pay, local cards (FAB, ADCB, etc.)

Vehicle tuning: Climate-optimized interiors (sunshades, cooling seats)

AV routing: Heat-aware routing, signage + lane marking optimizations

4. Launch playbook

🚀 Launch phases

🔹 Phase 1: Closed Beta

📍 Scope: 50–100 autonomous vehicles in JLT & Downtown Dubai

🎯 Focus: Ensure ride quality, study user adoption, validate safety metrics

🔹 Phase 2: Public Launch

📍 Scope: Expand coverage to Marina, DXB Airport, and Expo City

🎯 Focus: Scale operations, launch public app access, enable enterprise use-cases

5. Marketing & growth

🚨 PR Launch with RTA + Ministry of AI

🎟️ 10,000 Free Rides for early users

✈️ DXB Airport Kiosks for tourist onboarding

📱 Influencer Marketing via tech/travel creators

🎤 GITEX Presence (UAE’s largest tech event)

6. Success metrics

🌟 Ride NPS: > 70

🚗 Rides per AV/day: > 10 during beta, > 20 post public launch

🔁 30-day User Retention: > 40%

🛑 Safety Incidents: Zero critical events

📄 Time to Regulatory Readiness: < 3 months

📱 App Store Rank (Transport category): Top 10

7. Feedback loop & scale

Real-time feedback via in-app + in-car UI

Weekly review of:

Routing failures

Support tickets

Zone-wise usage

Iterate pricing, UX, dispatch logic

Plan Abu Dhabi next → Doha or Riyadh in 18–24 months