Uber is reinventing itself in India to survive

A must (must) read! Why did Uber India move to a subscription-based model for autos? What risks Uber faces in US/India? What should be Uber's 10 year product strategy?

Hi, folks! Good morning :)

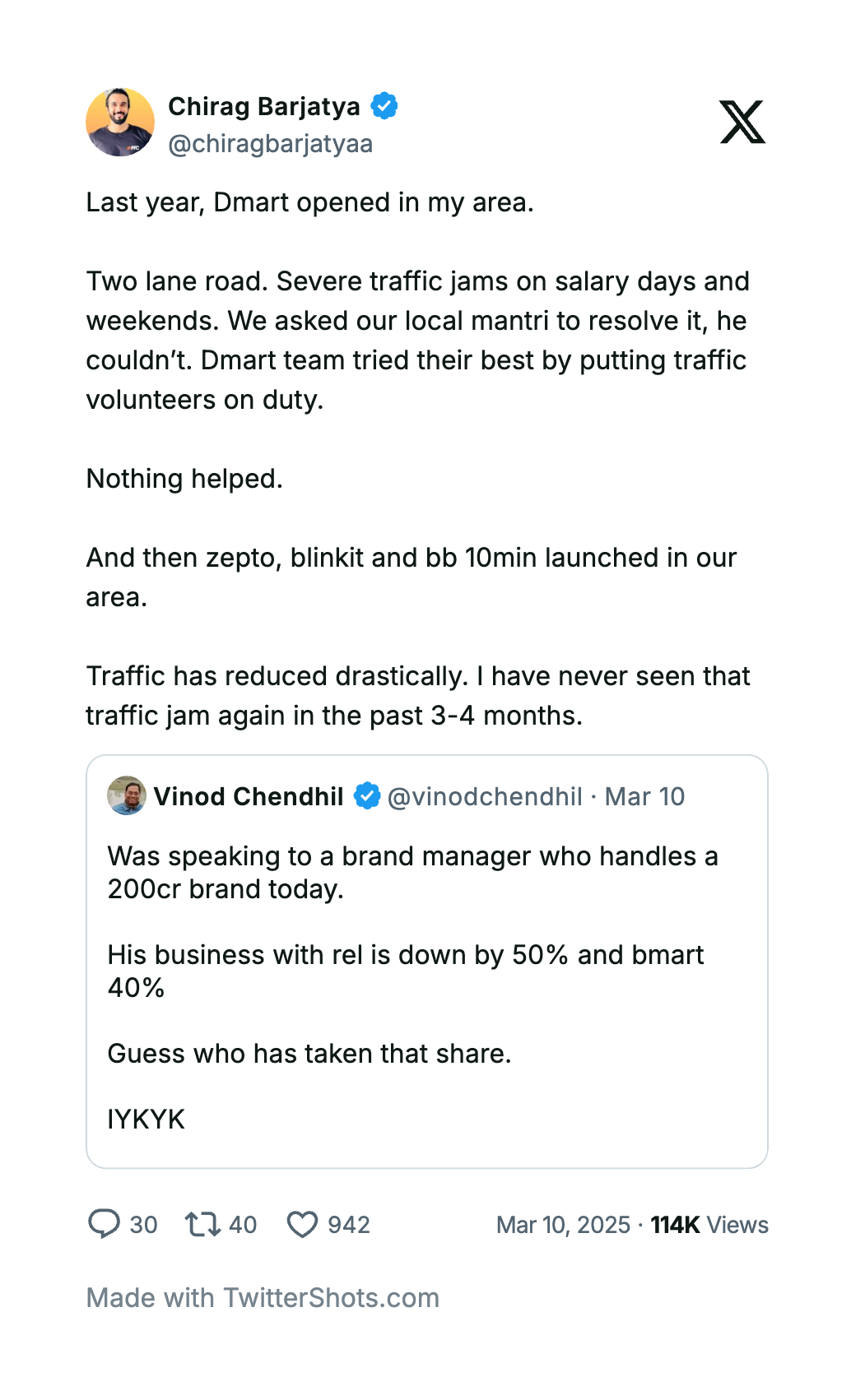

This tweet caught my attention recently. While the US 🇺🇸 and China 🇨🇳 are busy building cutting-edge AI models 🤖, India 🇮🇳 innovation in certain pockets of fintech & consumer tech is at just next level.

Let me take you back in time. Hear this out—Indian customers are so demanding and don’t want to pay for anything (😂). It’s the toughest market in the world. This is what Uber CEO Dara Khosrowshahi said during his last trip to India.

India is an insignificant market for Uber. Out of its $37.28 billion revenue in 2023, less than 1% came from India. While Uber made $10 billion in profits in the U.S. 🇺🇸, in India 🇮🇳, it operates at a 10% loss, not even achieving break-even.

And then came last week’s biggest news 🚨: Uber India shifted to a subscription-based pricing model (acting like a tech platform, similar to Namma Yatri) instead of its usual commission-based approach for autos.

From marketplace to SaaS 🔄—Uber is now going back to square one, similar to how Meru started, shifting from commission-based earnings to subscription fees from drivers. Let’s break it down! 📉📊

Venture money is recouped in markets that change behavior, as it creates winner-takes-all dynamics. Uber holds the lion’s share in the U.S market now. 🦁

Uber lost $34 billion before turning profitable 💸, it raised a total of $40 billion, and made $10 billion in profit last year, growing at 20% YoY 📈 on such a large base. It will recoup its venture dollars in just three years.

In India, venture capital isn’t playing out the same way for cab businesses 🚖. Ola’s and Uber’s market share is declining with the rise of BluSmart ⚡ and Shroff’s premium service, both of which are hitting their margins. With government also innovating with initiatives like ONDC 🇮🇳, it’s becoming clear that the Indian ride-hailing market isn’t a winner-takes-all game.

I have taken considerable time to deep-dive into this topic. I hope you will share your views in the comments—I’ll read all of them! 👀💬🚀

Why did Uber make the switch? 🚗

1️⃣ Market dynamics & competition

Namma Yatri & ONDC disruption: Platforms like Namma Yatri, powered by ONDC, are cutting out the middleman with zero commissions, putting pressure on Uber’s market share.

New competitors: With players like Rapido, BluSmart (EV-based), and Shoffr emerging, Uber’s market share isn’t expanding.

Govt’s push for public infrastructure: The Indian government is encouraging ONDC-based mobility, aiming to reduce dependence on private players.

2️⃣ Unit economics & driver retention

High commissions = Lower driver earnings: Uber previously took 20-30% per ride, reducing driver income.

Delayed payouts: Drivers faced cash flow issues due to 2-3 week delays in payouts.

Drivers switching to alternatives: Platforms like Namma Yatri allows drivers to collect fare directly.

Flat subscription = Lower costs for drivers: Now Uber charges ₹20-₹40/day, which is a lot cheaper than the 25% commission they previously took.

Financial implications for Uber

Earlier, an auto driver could earn ₹1,000/day. Uber took ₹250 (25%). Now, Uber takes only ₹20-₹40/day. That's around 1/10th of what they used to take

Impact → If Uber autos contribute 20% of India revenue (~$150M), shifting to subscriptions could slash Uber’s per-driver revenue by 90%, requiring a 10x increase in active drivers just to break even

Impact on consumers 🚀

✅ Pros

Lower fares: Since drivers keep 100% of their earnings, fares drop.

Fewer ride cancellations: Drivers won’t refuse rides based on payment or route profitability, leading to fewer cancellations.

Transparent pricing: No surge pricing; fares can be government approved or fixed.

Happier drivers: More satisfied drivers = better service and fewer issues.

❌ Cons & challenges

⚠️ Uber becomes a mere tech platform for autos– Since Uber now operates as a subscription-based SaaS model, it distances itself from direct involvement in auto ride economics, moving away from dispute resolution and customer support

⚠️ Who takes safety liability? – Uber heavily invested in platform trust & safety

(background checks, SOS buttons, trip tracking). With the new model, does Uber still hold responsibility for consumer safety, or does it shift to the driver?

⚠️ Lack of trip insurance & support – With Uber stepping back as a marketplace operator, rider safety policies and support mechanisms could become less stringent.

Are you a Product Manager? Do APIs intimidate you in interviews or when talking to engineers?

I’ve written an ebook, API for Product Managers, which was rated #1 on Product Hunt. Now, I’m conducting a 2-day live cohort on APIs.

Enroll now: https://www.xplainerr.com/cohorts/api-for-pms

Way forward for Uber India 🚀

Hybrid model – Keep commission-based pricing for high-trust, premium rides (Uber Premier, Uber XL) while using subscriptions for regular rides.

Safety subscription – Charge a nominal fee for verified drivers, trip insurance, and 24/7 customer support.

Govt-backed safety compliance – Work with regulators to mandate driver verification & safety standards.

Let’s add PM interview flavour to the remaining part of today’s newsletter.

What major challenges Uber faces globally & in India? Also how would you build a 10 year long product strategy for Uber?

🇺🇸 Uber’s challenges in the US

1️⃣ 🤖 Self-driving car disruption

Waymo surpassed Lyft ridership number in SF. Self driving cars adoption are no more just a case study. Trend is clearly moving towards self driving cabs

Driverless taxis = lower fares → pressure on Uber’s margins & gig workforce. Uber needs to innovate its business model

Uber’s self-driving exit (2020) → now dependent on partnerships, losing edge. Uber tried partnership with Tesla, which didn’t materialise. Uber is trying partnership with Waymo now.

2️⃣ ⚖️ Regulatory & legal battles

Gig worker laws (Prop 22, AB5 in California) → push for driver employee benefits, pushing ride fare compared to self driving cars

Rideshare lawsuits & unionisation → increased compliance & operating costs

Surge pricing scrutiny → potential caps, hurting peak-time profits

3️⃣ 💰 Profitability & market saturation

Highly penetrated market → Uber is at $10bn profit, growing 20% YOY. AV cars & large base puts a question on growth

Food delivery (Uber Eats) faces stiff competition from Doordash & Instacart

Rising insurance & fuel costs impact driver incentives, reducing supply

🇮🇳 Uber’s challenges in India

1️⃣ 🏛️ Government & ONDC disruption

ONDC-backed ride-hailing (e.g., Namma Yatri) → threat to Uber’s dominance. Zero cost infra

Fare caps by state governments, compliance laws like gig workers law make profitability harder

2️⃣ ⚔️ Hyper-competitive, fragmented market

India ≠ winner-take-all → Rapido (bikes), BluSmart (EVs) eat into Uber’s share

BluSmart’s EV model pulls premium users, hurting Uber’s high-margin play

Metro expansion & cheap public transit reduce cab demand for short-hauls

3️⃣ 💰 Price sensitivity & profitability struggles

India = just 1% of Uber’s revenue but remains a key R&D hub

Government is a direct competitor to private players like Uber by making marketplace open source; making sustainable growth tough

🚗 Uber 10 year roadmap

1️⃣ Short-term (1-3 years): Strengthen core business

Driver retention: Higher earnings via upfront fares, instant cashouts, and better incentives

AI-powered safety: Real-time fraud detection, dashcam integrations, and rider verification

Regulatory & legal: Proactively shape gig worker laws and prevent aggressive state-level restrictions

India focus: AI-based fraud detection and multilingual driver support to improve safety and experience

2️⃣ Mid-term (3-7 years): Diversification & profitability

Super app play: Integrate rides, delivery (Uber Eats), and payments into a seamless experience

Fleet cost optimization: Scale EV partnerships (Tesla, Hertz) and autonomous-ready rentals

SaaS & enterprise: Expand B2B mobility (Uber for Business) and launch fleet management software

India focus: Expand electric fleet partnerships with Tata & BluSmart and introduce ride pooling at scale

3️⃣ Long-term (7-10 years): The future of Uber

Full autonomy: Scale AI-driven fleets via Waymo, Tesla, or in-house tech (ATG 2.0)

Mobility subscriptions: Uber Pass for all transport and a fixed-fee driver SaaS model

New frontiers: Urban air mobility (eVTOLs) and automated freight (Uber Freight AI)

India focus: Develop affordable autonomous fleets and integrate multi-modal transport (Metro + Auto + EV) for emerging cities

Are you a Product Manager who struggles with APIs? Do tech discussions feel overwhelming?

I’ve simplified it for you! Join my 2-day live cohort on APIs—designed for PMs, not engineers. Learn API concepts, design, and security hands-on.

🚀 Enroll now: https://www.xplainerr.com/cohorts/api-for-pms

I am planning to create product management content on Instagram too. If you are on Instagram, you can follow me here - https://www.instagram.com/venky_gupta5/